Unveiling Gen Z Alcohol Trends and Ecommerce Insights for 2023

Understanding the latest alcohol trends among Gen Z consumers is essential for CPG brands seeking to stay ahead in the dynamic market of 2023. In this blog post, we delve into Gen Z's alcohol buying and consumption habits, exploring key statistics and shedding light on their preferences.

Gen Z Alcohol Trends for 2023

As we explore the alcohol trends for 2023, it's evident that Gen Z consumers continue to play a significant role in shaping the market landscape. With 73% of our survey respondents having purchased alcohol in the past 90 days, Gen Z represents a prime target audience for CPG brands.

In line with the broader ecommerce boom, alcohol ecommerce trends are gaining traction among Gen Z consumers. Our survey reveals that one in five respondents have purchased alcohol online in some capacity. This number is likely to increase in the coming years, highlighting the importance of establishing a strong online presence and optimizing ecommerce platforms to cater to Gen Z's preferences.

Gen Z Retail Trends

To adapt to Gen Z retail trends, CPG brands must understand where and how these consumers shop for alcohol. Among respondents, 54% preferred brick-and-mortar stores.

Particularly of note, 44% incorporated alcohol shopping into their overall grocery trips. This is further reinforcement of the importance of convenience to shoppers. As the top driver of online grocery orders, convenience has never been more important. Additionally,

When asked specifically about the types of retailers frequented for purchase, 32% purchased alcohol from liquor stores or specialized retailers, while 30% opted for grocery store purchases. Brands should use these to strategically position their products across various retail channels.

Key Drivers of Gen Z Alcohol Sales

When targeting Gen Z consumers, it is vital to understand the key drivers of alcohol sales. In 2023, special occasions continue to have a significant impact on alcohol purchasing, motivating 57% of Gen Z respondents. Brands can capitalize on this trend by aligning their marketing efforts with relevant occasions and creating promotional campaigns that resonate with the generation’s celebratory mindset. Offering special deals and promotions can further influence their purchasing decisions.

It’s also worth noting that one in four respondents keep their at-home bars stocked in an effort to avoid $20+ cocktails they’re likely to have to shell out for at bars and restaurants.

Gen Z's Decision-Making Factors

In the competitive alcohol market, brands need to be aware of the factors influencing Gen Z's decision-making process. Our survey indicates that flavor and taste top the list, with 61% of respondents considering them key factors. Price closely follows at 62%, while quality (41%) ranks third. By prioritizing these factors and effectively communicating them to consumers, CPG brands can build strong connections with this demographic.

Stealing Category Share with Gen Z

As we delve deeper into the alcohol trends for 2023, it's clear that Gen Z's preferences and behaviors continue to shape the market. The challenge for CPG brands looking to steal category share lies in capturing the attention of this demographic and adapting to its evolving tastes. Price remains a significant hurdle, with 50% of respondents indicating it as a potential motivator to switch brands. Flavor and taste (46%) also play a crucial role in enticing Gen Z consumers away from their preferred choices.

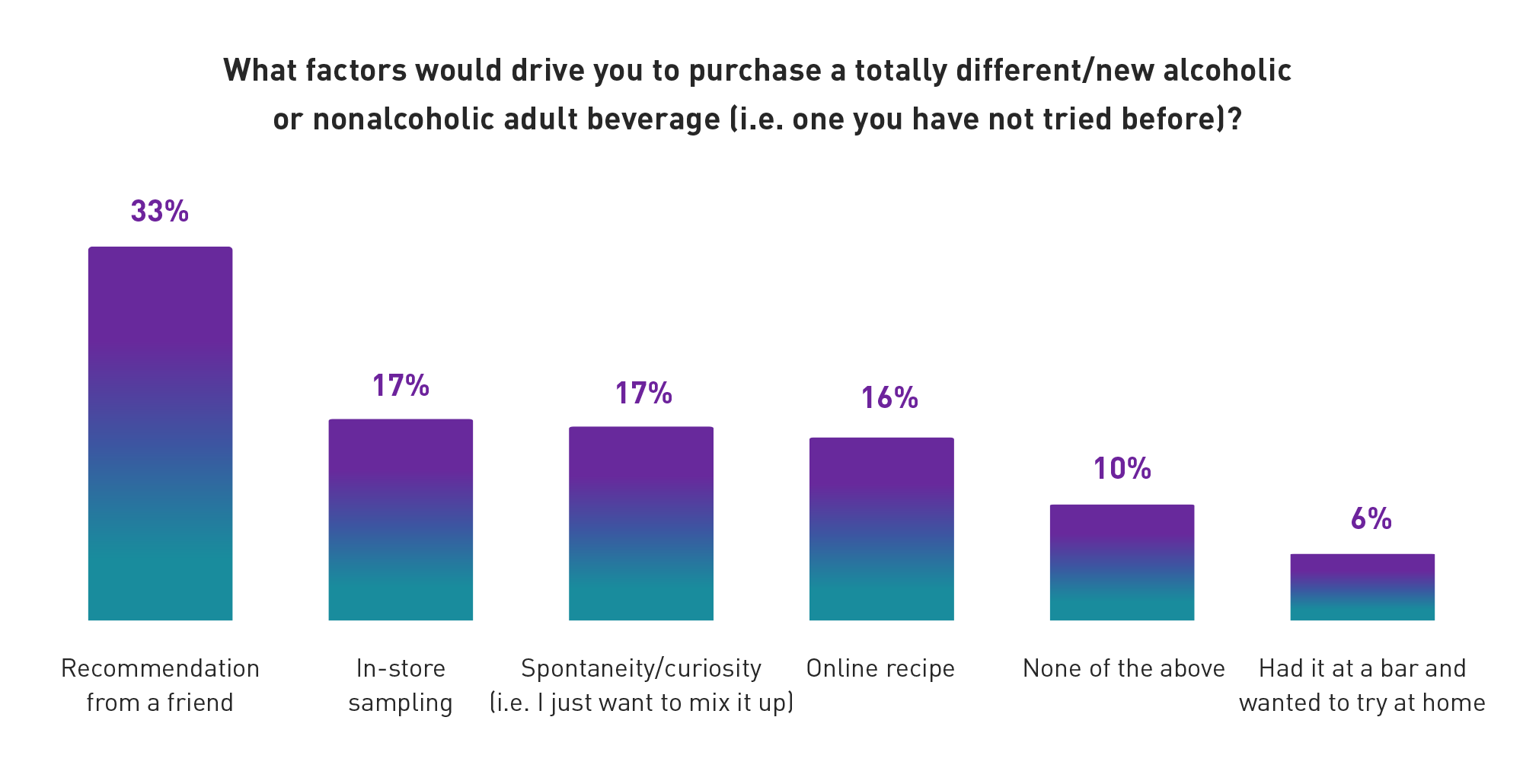

Harnessing Recommendations and Contextual Experiences

To attract Gen Z consumers to new alcoholic beverages, effective strategies include leveraging recommendations from friends, and contextually-relevant experiences. Recommendations from friends had the biggest likelihood to drive purchases from truly new shoppers (33%). Seventeen percent are influenced by in-store sampling and 16% by recipes online. By reaching shoppers in contextually relevant settings — via in-store tastings or contextual advertising — CPG brands can successfully introduce and promote new products to Gen Z consumers.

Emerging Gen Z Alcohol Preferences

Examining Gen Z's preferred alcoholic beverages for 2023, we find that liquor retains its top spot at 20%, closely followed by wine at 19%. But shortly behind is a lack of interest in purchasing alcohol, at 18%. Hard seltzers continue to gain popularity, securing 13% of preferences, while beer trails behind at 11%.

Non-Alcoholic Beverages

For CPG brands, these insights provide valuable guidance in product development and positioning for CPG brands to meet Gen Z's evolving tastes.

27% of Gen Z respondents have not purchased alcohol in the last 90 days.

18% of Gen Z respondents have not purchased alcohol for themselves in the last 90 days.

10% opt for NA beers, while 7% opt for non-alcoholic wine.

12% will purchase NA options to serve guests when hosting.

Why the interest in non-alcoholic adult beverages?

Gen Z is reputed for its health and wellness focus. This was only confirmed by our research: 30% have intentionally reduced their alcohol consumption to improve overall health and well-being. Gen Z has also been highlighted as a more inclusive and socially conscious generation. They are often mindful of the diverse needs and preferences of people in their social circles. Non-alcoholic beverages provide options that cater to individuals who do not drink alcohol due to personal, religious, or cultural reasons, ensuring inclusivity in social gatherings. Those who lack interest in alcohol purchases may be more likely to convert to purchasing non-alcohol spirits or beverages

Embracing Contextual Commerce

Exploring the concept of contextual commerce will be a game-changer in capturing Gen Z's attention.

By seamlessly integrating alcohol-purchasing options within food-related content, brands can engage with Gen Z consumers in an active mindset, aligning with their shifting preferences in this category.

To further enhance their reach, CPG brands should seize the opportunity to embrace contextual commerce. By strategically placing relevant alcohol products within food-related content, brands can create a seamless and useful experience for Gen Z consumers while forging strong connections, driving conversions, and maximizing their impact in the ever-evolving alcohol market of 2023.